Now that more details are known about the three V2G propositions (🇩🇪BMW / E.ON, 🇫🇷 Mobilize / Renault / The Mobility House Energy, 🇬🇧 Octopus Energy) currently available or announced in Europe, it is time to compare them.

The average price per kWh paid by households varies considerably from country to country, as does the composition of that price. All three V2G contracts aim to enable the average user to drive for free with an annual mileage of around 11,000–14,000 km: in this case, the V2G revenues that the energy supplier receives and pays out or settles with the user must cover the charging costs. (In the case of Octopus’s Power Pack in the UK, it is an ‘add-on’ to another electricity tariff and is included in a BYD Dolphin lease package.)

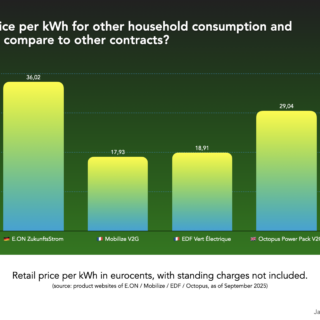

It is interesting that all three energy contracts work with a fixed electricity price for the user, which is competitive with ‘traditional’ contracts (although I have not considered standing charges). Behind the scenes, they use smart meter values to exploit flexibility in charging and discharging in different markets and flexibility mechanisms. Some of these may not yet be available, or may be awaiting regulatory changes, but this complexity does not affect the user.

Users retain control over when their vehicle is fully charged, including charging as quickly as possible. The most important ‘currency’ is the flexibility to charge outside of the time needed to fully charge the car battery to the desired departure time. In general, the longer and more often the car is plugged in, the better. This makes sense as it gives the supplier more scope to charge the vehicle at low-cost times and discharge it at times when prices are high.

The impact of network tariffs, whether time-variable or not, has not yet been factored into these prices.